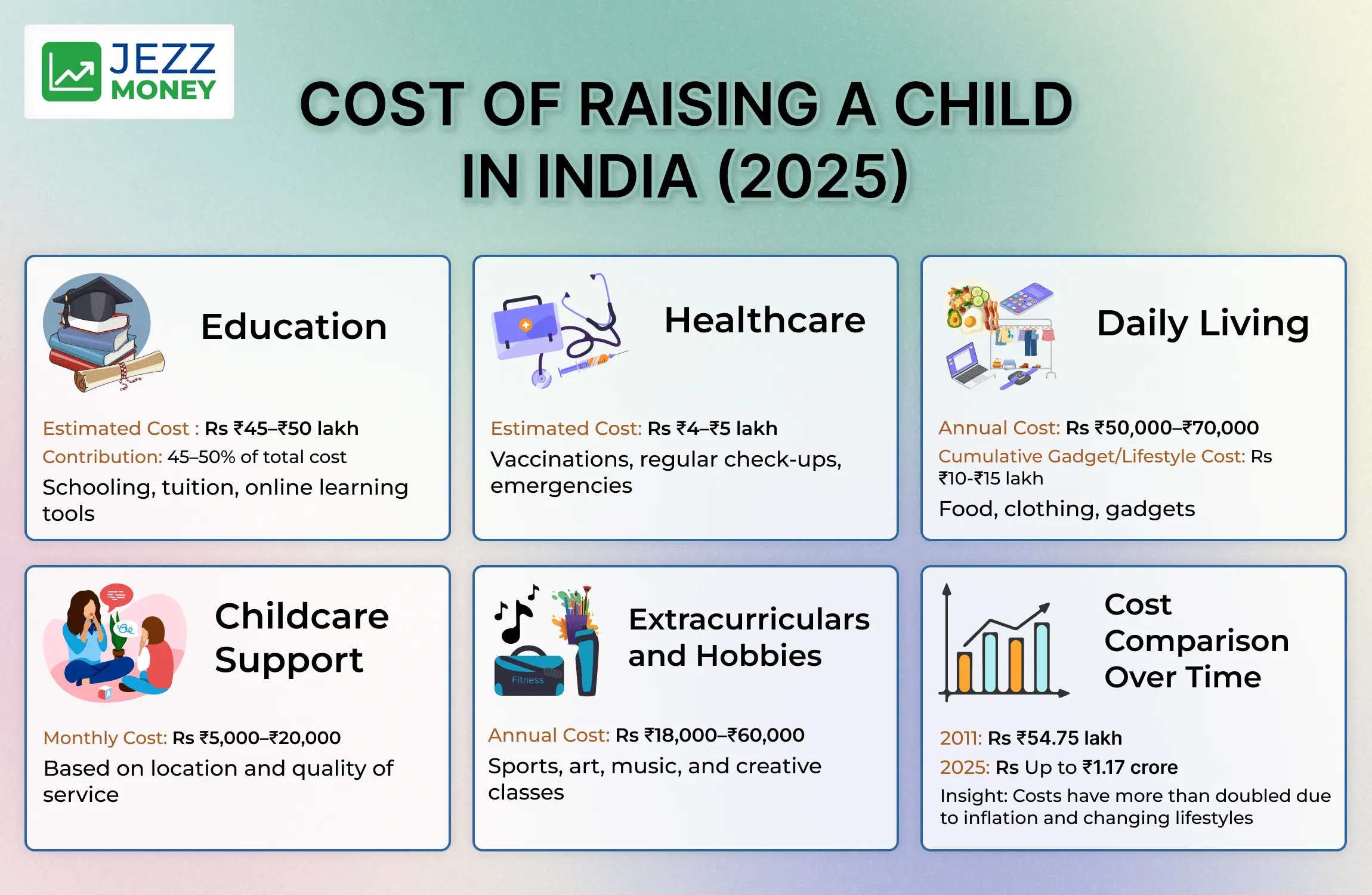

Raising a child in 2025 has become more expensive than ever, with rising costs in education, healthcare, extracurricular activities, and necessities. From daycare fees to digital learning tools, the financial demands of modern parenting are steep. That's why strategic financial planning is no longer optional. Parents must proactively budget, track expenses, and invest in their child's future from an early stage. Leveraging child-focused savings plans, educational insurance, and long-term investments like mutual funds or SIPs can make a substantial difference. Teaching kids financial literacy and involving them in small money decisions also builds lifelong money habits.

Every wise financial choice made today lays the foundation for a more secure and opportunity-rich tomorrow. By balancing daily needs with long-term goals, you're not just managing expenses, you're building a future. Start early, stay consistent, and let your money grow with your child's dreams.